Business Partnering

Our Virtual CEO/CFOs work with businesses to unlock the business potential.

CFO/Business Partner for Businesses

In today’s uncertain business world business leaders must be able to learn to adapt faster than the rate of change in their markets.

But this prevailing climate of uncertainty increases the pressure on leaders to spend their time “in” the business addressing day-to-day activities that drive today’s performance and results, making it difficult to find sufficient headroom to spend “on” the business, considering how best to make the right changes that lead to sustainable growth and success.

The pace of change and the compelling need for business leaders to adapt can be overwhelming. What is the right decision? Who do I listen to? Where can I get help?

Sustaining and growing value comes from making the right strategic choices and then aligning the business model, stakeholder requirements, management, communications and risk management to those choices.

Uncertainty demands a focused but creative response on what matters most to you.

You can benefit from our experienced professional experts in navigating through the current challenging business environment, so that you can focus on running your business.

- Financial Management & Reporting

- Solvency & Liquidity

- Investment Decisions

- Tax Planning

- Strategic Planning

- Financial Planning & Analysis

- Profitability Improvement

Financial Management & Reporting

Traditionally, the finance function has been viewed as a transactional processing department that exists only to meet statutory compliance requirements and to provide scorecards on past performances (lag indicators). In today’s rapidly changing operational environment, this is no longer the case.

An effective finance function is now critical to enabling organisational success. The role of today’s finance function has broadened – in addition to meeting statutory requirements, successful finance executives are required to partner with the business leaders to build and execute on longer term strategy.

Solvency & Liquidity

Everyone knows making profit generates cash flow, however what may not be known is that the actual increase in cash during a given period is invariably lower or higher than the profit number. Understanding how cash flow relates to profit is critical for businesses.

Solvency and liquidity both measure the ability of an entity to pay its debts. Solvency has a long-term focus, while liquidity addresses short-term payments. Solvency refers to the ability of a business to pay its liabilities on time. Solvency measures whether or not a company is viable — a business that can generate sufficient cash flow to operate over the long-term (multiple years).

Liquidity, on the other hand, refers to the ability of a business to keep its cash balance and cash flows at adequate levels so that operations aren’t disrupted by cash shortfalls. When considering liquidity, the focus is on the next six months or the next year.

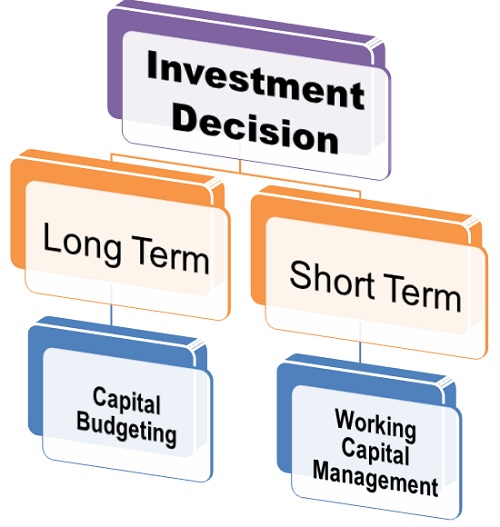

Investment Decisions

This relates to the decisions made by the businesses with respect to the amount of funds to be deployed in the investment opportunities in either long-term or short-term assets.

The decision of investing funds in the long-term assets is known as Capital Budgeting, is the process of selecting the asset or an investment proposal that will yield returns over a long period:

- Select the asset, whether existing or new on the basis of benefits that will be derived from it in the future.

- Ascertain uncertainty and risk involved in it as the benefits are to be accrued in the future, the uncertainty is high with respect to its returns

- The minimum rate of return is to be set against which the performance of the long-term project can be evaluated

The investment made in the current assets or short-term assets is termed as Working Capital Management. The working capital management deals with the management of current assets that are highly liquid in nature.

The investment decision in short-term assets is crucial for an organization as short-term survival is necessary for the long-term success. Through working capital management, a firm tries to maintain a trade-off between the profitability and the liquidity.

In case a business has an inadequate working capital may not be able to pay off its current liabilities and may result in bankruptcy. Or in case it has more current assets than required, it can have an adverse effect on the profitability of the business.

Thus, a business must have an optimum working capital that is necessary for the smooth functioning of its day to day operations.